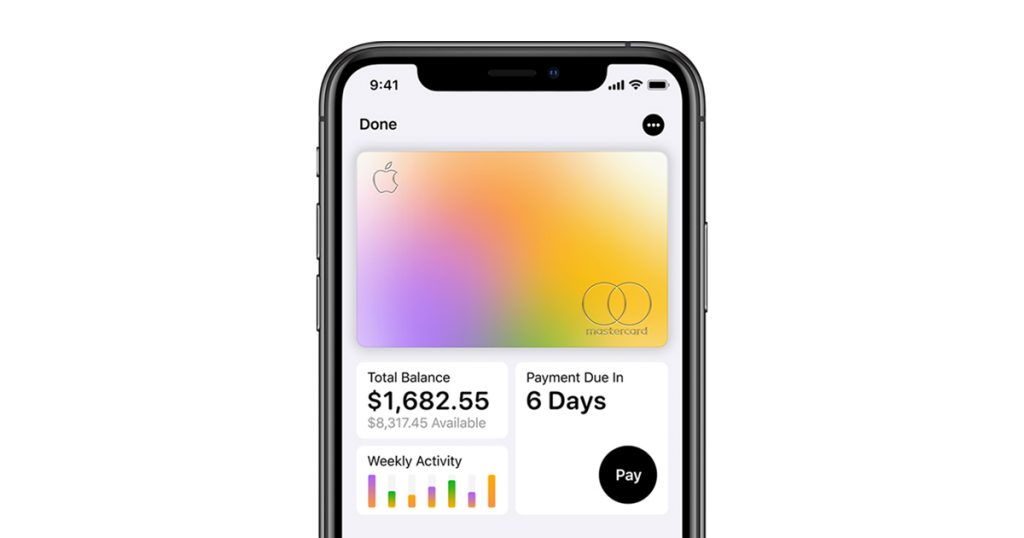

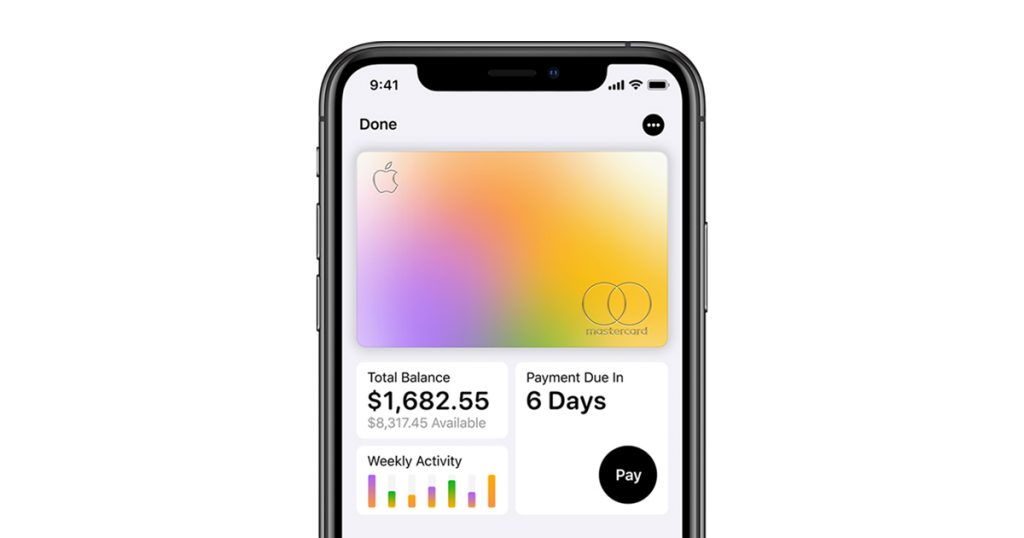

Apple recently revealed the details of its new credit card, which they have teamed up with Goldman Sachs on; the Apple credit card is designed to be used with Apple Pay. Some of the perks offered with the card include daily cash back, no annual fees, no late fees, and interest rates that are among the lowest when compared to others in the industry. Only those who have the Apple card will be able to access special features in the Apple Wallet app.

As exciting as this new credit card sounds, consumers should keep in mind a few things. For one, the card is designed to promote Apple Pay, possibly because mobile payments have still not caught on in the US as it has in other parts of the world, such as China for example. This is mainly due to merchants being slow adapting to new technology, and so fixated on the transition of chip-and-PIN cards.

PayPal, including Venmo, has 267 million users, compared to the 32 million Apple Pay users, according to research from Richard Crone, a consultant in the payments industry. Following Apple Pay are Walmart Pay with 31 million users and Starbucks with 25 million users.

The special features in the Apple Wallet app is Apple and Goldman’s plan to make the card competitive over others. Those who use the card will be able to track their spending, and purchases will be sorted into color-coded categories to make everything visual and easier to read. It is also expected to have features similar to those of a savings app, where users can set spending goals, budgeting and managing their card.

Another thing that consumers should keep in mind is the fact that mobile payments can affect how you spend money. “Any way you make spending less tangible, there is that risk you’ll spend more because you’re not actually seeing that money come out of your wallet,” said Arielle O’Shea, a credit card expert at NerdWallet. According to a recent report from Zion Market Research, researchers found the following:

- The total amount of money consumers spent increased 2.4% after the adoption of mobile payments.

- The total number of retail transactions also went up by more than 23%, largely because people were buying low-cost items more frequently.

- The amount spent using physical credit cards fell by 3.9%.

- People spent slightly more money online after they started using this mobile wallet.

- Using a mobile wallet made people more likely to spend more on food, entertainment and travel, but didn’t affect spending on education or health care.

Aside from this being a way for users to spend more money, Apple and Goldman Sachs will be able to collect data on what consumers prioritize in their financial lives through features added to the Apple Wallet app, leading to targeting customers for different financing options and credit cards to suit them. As it is a breakthrough for Apple to jump into another industry, you may want to consider these and other possible factors before applying for an Apple Card.